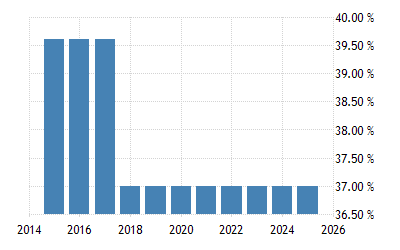

The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. On subsequent chargeable income 24.

Bursa Dummy Tax On Rental Income

On the First 5000 Next 15000.

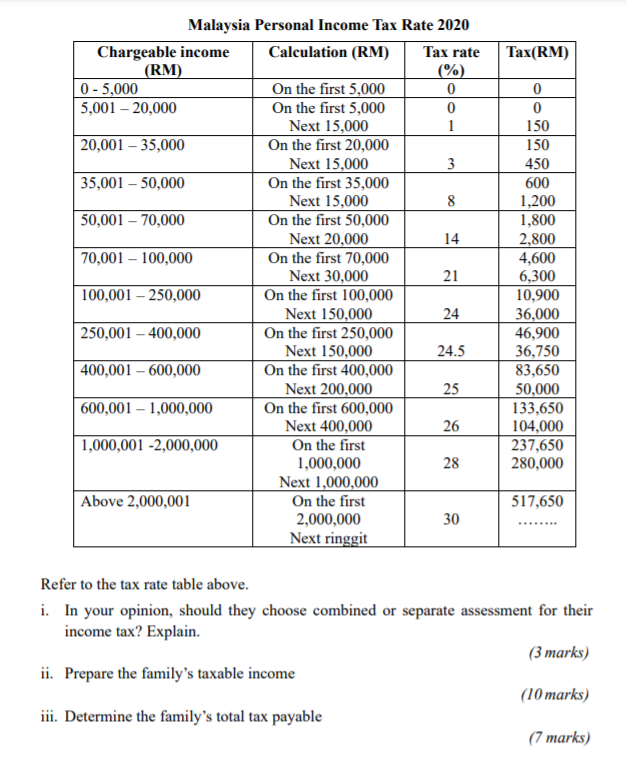

. Calculations RM Rate TaxRM 0 - 5000. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while non-residents are taxed at a flat rate of around 30. Income Tax Rates and Thresholds Annual Tax Rate Taxable Income Threshold.

Resident individuals A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a. 13 rows Malaysian ringgit A non-resident individual is taxed at a flat rate of. Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary after tax.

So the more taxable income you earn the higher the tax youll be paying. Taxable income band MYR. Based on this amount the income tax to pay the government is RM1640 at a rate of 8.

On the First 20000 Next 15000. On the First 35000 Next 15000. Taxable income band MYR.

Malaysia Income Tax Rates and Personal Allowances. Malaysia adopts a territorial approach to income tax. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the.

C Dividends interest or discounts. Expatriates deemed residents for tax purposes pay progressive rates between 0 and 30 depending on their income. Malaysia has a territorial tax.

B Gains profit from employment. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will remain the. A Gains profit from a business.

This booklet also incorporates in coloured italics the 2023. Tax is imposed annually on individuals who receive income in respect of. Tax reliefs and rebates There are 21 tax reliefs available for individual.

Per LHDNs website these are the tax rates. Malaysia Residents Income Tax Tables in 2022. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

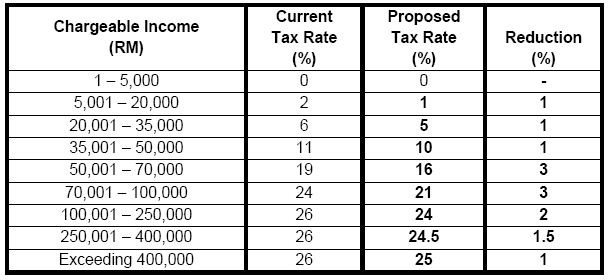

Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. However there are exceptions for certain. Taxable income band MYR.

At the time of writing personal income tax for Malaysian tax residents is progressive from 1 - 30 depending on income level. Resident company with paid-up capital above RM25 million at the beginning of the basis period 24. The Malaysian corporate standard income tax rate is 24 applicable to resident or non-resident companies that earn revenue inside Malaysia.

An effective petroleum income tax rate of 25 applies on income from. On the First 2500. They are also eligible for tax deductions.

The non-resident tax rate in Malaysia is. Your tax rate is calculated based on your taxable income. Non-resident company branch 24.

Chargeable income RM20000 Total tax amount RM150 Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. Rates of tax 1.

Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. If taxable you are required to fill in M Form. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia.

However if you claimed RM13500 in tax.

Malaysian Tax Issues For Expats Activpayroll

Borang Tp 1 Tax Release Form Dna Hr Capital Sdn Bhd

Colombia Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

As Tax Changes Brew In Congress Outlook Is Grim For Pass Through Owners

Personal Income Tax Asean Asean Business News

Malaysia Personal Income Tax Rates 2022

Pdf Marginal Income Tax Rates And Economic Growth In Developing Countries Semantic Scholar

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Question 1 20 Marks Jafri And Hazel Are Married Chegg Com

Individual Income Tax In Malaysia For Expats Gpa

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

United States Personal Income Tax Rate 2022 Data 2023 Forecast

Abss Payroll V11 What S New Abss Accounting Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Income Tax Formula Excel University

Income Tax Malaysia 2019 Calculator Madalynngwf

Corporate Tax Malaysia 2020 For Smes Comprehensive Guide Biztory Cloud Accounting